What the One Big Beautiful Bill Means for Student Loans

On July 4, 2025, the president signed the One Big Beautiful Bill (OBBB) into law, triggering some of the biggest student loan changes in decades.

Whether you're a student loan borrower, a Parent PLUS loan holder, or planning to take out loans for college or grad school—here’s what you need to know.

A Quick Recap: Income-Driven Repayment (IDR) Plans

Before OBBB, borrowers had access to several income-driven repayment (IDR) options:

Existing Student Borrowers

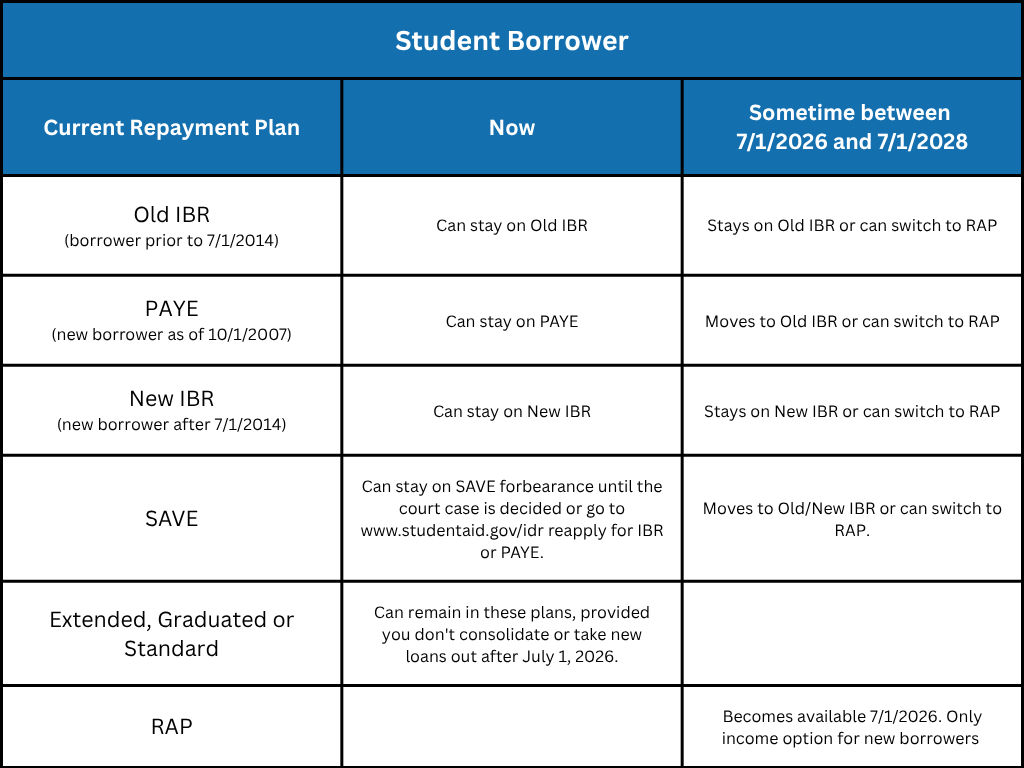

The bill eliminates the SAVE, PAYE, and ICR repayment plans for current borrowers. If you’re enrolled in one of these, here’s what will happen:

Transition Period: Between July 1, 2026, and June 30, 2028, all borrowers on SAVE, PAYE, or ICR will be transitioned into either the Old IBR or New IBR plans.

SAVE Could End Sooner: A pending court case could accelerate the phase-out of the SAVE plan. If that happens, borrowers may be moved to IBR earlier.

You Can Stay—for Now: You can remain on your current repayment plan until it is formally phased out.

I have included a chart below that summarizes the changes.

If you're pursuing Public Service Loan Forgiveness (PSLF), you’ll want to ensure you're on a qualifying plan like the IBR or PAYE repayment plans.

The website is not allowing some borrowers to apply for PAYE that are eligible. If you think you are eligible and PAYE is not showing online, you might have to do a paper IDR application and upload it to your loan servicer.

If you’re on PAYE and won’t reach forgiveness by 2028:

You’ll need to repay 5 extra years on Old IBR or

10 more years under the new Repayment Assistance Plan (RAP)

I expect there to be future lawsuits by PAYE borrowers to try and keep this plan or be switched to the very similar New IBR plan.

Existing Parent Plus Borrowers

This bill could have been much worse for Parent PLUS borrowers, but thanks to strong advocacy, some of the most damaging provisions were removed. The bill eliminates the SAVE, PAYE, and ICR repayment plans for current borrowers. If you’re enrolled in one of these, here’s what will happen:

Transition Period: Between July 1, 2026, and June 30, 2028, all borrowers on SAVE, PAYE, or ICR will be transitioned into either the Old IBR or New IBR plans.

SAVE Could End Sooner: A pending court case could accelerate the phase-out of the SAVE plan. If that happens, borrowers may be moved to IBR earlier.

You Can Stay—for Now: You can remain on your current repayment plan until it is formally phased out.

ICR Requirement Removed: You don’t need to be in ICR at the time of enactment to qualify for IDR.

Consolidation Deadline: You must consolidate Parent PLUS loans by June 30, 2026 to become eligible for IBR.

I have included a chart below that summarizes the changes.

If you applied for ICR and they did not process it yet, call your loan servicer and cancel the application and you should go back to your previous repayment plan and payment amount.

If you applied for ICR and they did process it, then go to www.studentaid.gov/idr and apply for the PAYE or IBR. A new application cancels out an old application.

The website is not allowing some borrowers to apply for IBR or PAYE that are eligible. If you think you are eligible and it is not showing online, you might have to do a paper IDR application and upload it to your loan servicer.

If you are trying to accumulate PSLF credit, then you should get be on IBR or PAYE.

If you are taking out another parent plus loan for next school year, consolidate it in January 2026 to be eligible for IBR.

If you have to borrow past next school year (2025-2026) then you need a plan as all of your loans have to be on the same repayment plan so that would have all of your loans ineligible for any income drive repayment plans and loan forgiveness.

It could make sense to use private student loans depending on the situation.

Future Parent Plus Borrowers (starting 7/1/2026)

Borrowing caps:

Parent PLUS loans will be capped at $20K/year and $65K total per child.

Parent Plus loans taken before 2026 will not be counted against new caps.

There is a three year grace period for Parent PLUS loans if you've already borrowed on in 2025-26. You can continue for three additional academic years or until the end of the program (as long as it's less than 3 years).

If you borrow past next school year (2025-2026) then you need a plan as all of your loans have to be on the same repayment plan so that would have all of your loans ineligible for any income drive repayment plans and loan forgiveness.

It could make sense to use private student loans depending on the situation.

No IDR or forgiveness: Parent PLUS borrowers will be ineligible for income-driven plans or forgiveness programs (except due to death or disability).

Parent Plus loans will only a standard repayment option. The new standard plan terms would be:

<$25,000: 10 years

$25-50k: 15 years

$50-100k: 20 years

>$100k: 25 years

Why it matters: Families will need to make up the difference using savings, 529 plans, or private loans—often at higher rates and with fewer protections. Parents who relied on these loans lose now-accessible options. Without income-based caps, monthly bills could rise significantly.

Future Grad Student Borrowers (starting 7/1/2026)

Fewer repayment plans: Borrowers must choose between:

A revised Standard Plan (10–25 year fixed-term).

A new Repayment Assistance Plan (RAP), which ties payments to income but extends forgiveness to 30 years.

RAP does count towards PSLF available in 10 years.

Graduate loan caps:

Graduate Students (Master’s): $20,500/year, $100,000 total

Professional degrees (law, medicine): $50,000/year, $200,000 total

Graduate and professional loan limits are in addition to what a student already borrowed for their undergraduate education.

The bill does include a grace period for Grad PLUS loans: borrowers who already received a Grad PLUS loan before June 30, 2026, can continue borrowing under current terms through the 2028-29 academic year.

If you have to borrow past next school year (2025-2026) then you need a plan as all of your loans have to be on the same repayment plan so your only income driven repayment option would be the RAP plan.

It could make sense to use private student loans depending on the situation.

Consequence: This shift could lead to a rise in private loan use which do not come with income-driven repayment protections and the ability to qualify for federal student loan forgiveness programs. If you're starting a graduate degree program in fall 2026 or later, you need to borrow with the expectation that you will have to bear the full cost with very little help from any income driven options unless you are going fro PSLF.

Need Help Navigating These Changes?

These changes are complex, but you don’t have to figure them out alone.

I help borrowers every day understand their options and avoid costly mistakes. Whether you’re looking to maximize PSLF, figure out consolidation, or plan ahead for your child’s college borrowing—I’m here to help.